Covid-19 showed many people how fragile their financial situation can be, and pushed them to look for other ways to earn money, day trading being one of the most popular options.

However, many doubt that anyone can become a day trader by themselves. Some think that you either have to be formally educated or even an insider to be a successful day trader.

Fortunately, you can become a day trader just by self-learning about it online from the comfort of your home. At first, you have to understand what a day trader is, then build fundamental knowledge of economics, watch a couple of courses and begin studying books. Finally, practice trading with virtual money until you turn a profit.

In this article, we will give you an in-depth guide to becoming a day trader, starting from the very basics of day trading and then recommending some of the best resources for learning it yourself.

If you’re interested in day trading because you wish to quit your job or want to pick up a new hobby, keep on reading this article.

Step 1: Decide If Day Trading Is For You

Due to the volatile nature of day trading, not everyone has what it takes to become a day trader.

While everyone can be an investor – you just have to put some money down every month or so to potentially earn money in the long term, day trading is a completely different beast.

Even the best day traders frequently lose money, and even the best day traders are winning just barely more frequently than they’re losing.

So the first step to learning day trading is to decide if it’s for you.

You definitely don’t want to spend hundreds of hours of work and lose thousands of dollars before understanding that you’re just not made for it.

To begin answering this question, you have to know what day trading is in the first place, how it differs from investing, what are the pros and cons of such an approach to the stock market, and finally self-reflect if you possess the necessary traits to become successful in day trading.

-> Read Also What Is An Autodidact?

What Is a Day Trader

There are many misconceptions about what is a day trader, and it comes as no surprise because there isn’t a “day-trading” degree that you can earn to get a job as a day trader.

It isn’t an official profession, but The Financial Industry Regulatory Authority (FINRA) defines a day trader as a trader who trades at least 4 times in a 5-day span.

Essentially, day traders are not concerned with the future and are looking to make as many and as profitable trades as possible on any given day.

It can result in huge profits that bring the riches as quickly as hitting the jackpot, but it can also make you lose everything in minutes.

Day trading is nothing like long-term investing. The latter is focusing on future prospects of the asset they’re thinking of buying, while day traders are speculating if their asset is going to rise in price tomorrow.

As a result, everyone can be an investor – you just have to put some money down every month or so to potentially earn money in the long term. However, day trading is a completely different beast.

It’s not something you can do once in a while, no. It’s something you live and breathe every single day. It’s a lifestyle.

Characteristics of a Successful Day Trader

In most other types of financial endeavors and money-earning methods, the most skilled people are always winning.

However, day trading is so volatile and complex, that even the most skilled day traders frequently lose money. Even the best of the best are winning just barely more frequently than they’re losing.

They are making big money not by always winning, but by having a huge budget, so even a 5% profit can result in a living wage.

Because of that, it takes a special kind of person to be a successful day trader.

Here’s a general list of personality traits that nearly all profitable day traders share:

Curiosity

To successfully predict how the price of assets is going to change in a day or two requires you to be up to date with everything that’s going on in the world right now.

A single press release by a company or a volcano eruption on some obscure island can impact the stock market.

That’s why curiosity is arguably the #1 personality trait every day trader must have.

To successfully turn a profit in the long-term, you have to be curious about literally everything that’s happening in the world.

You’ll have to read dozens of news articles every day, and the more – the better.

Most day traders are also curious not only about what’s happening right now, but what has happened in the past.

They usually read history books, because as the saying goes, history tends to repeat itself.

Discipline

Every crème de la crème day trader is disciplined. Selling an asset because it’s already profitable is not enough to become successful in the long term.

Waiting for a single hour can make a trade 10x as profitable as it was before, and you have to maximize your profits with every trade you make.

It applies to opposite scenarios. Selling an asset because it just turned red is a common mistake of beginners.

Being disciplined and not allowing your emotions to impact your decisions is the key to successful day trading.

Intelligence

Naturally, you have to be intelligent to be a winning day trader. Economics, finance, and math are difficult subjects, and they’re the basis of day trading.

However, day trading can be seen as a multi-disciplinary field that requires you to combine different types of information to make the best decision possible.

Wit/Street-Smarts

Raw intelligence is not enough, you also need to have so-called “street smarts”. Nearly every successful day trader would make it in the streets.

Thinking out of the box, applying unique methods, and looking at day trading from a distinctive perspective will give you the edge over the competition.

Step 2. Start From The Basics

If you’ve decided that you’re one of the few who can become a day trader, then it’s time to start learning. Unfortunately, you’re not going to make millions from day trading just yet.

First, you have to start from the basics and fundamentals of economics and the stock market.

It isn’t glamorous, but it’s a necessity. You can learn the basics from a high school-level economics textbook that’s collecting dust in your attic, but there are plenty of useful resources online:

Investopedia

Since its foundation in 1999, Investopedia has become one of the most popular websites for everything related to finance and economics, including day trading.

Here you can find straightforward articles on economics and stocks, and all the hottest market news.

Wikipedia

It gets a bad rep for not being accurate and biased. While it’s true to some degree, it doesn’t apply to articles on fundamental concepts.

Here you’ll find literally everything you need to know about economics and finance before you start learning day trading specific things.

Step 3. Go Through Introductory Courses

Now that you have a basic grasp of economics, you can start learning about day trading itself.

We recommend you go through an introductory video course of your choice.

Video content is easy to digest and offers the visual aspect which is so important when learning new stuff.

We would advise you to not pay money for a day trading course. Most of them are made by fake gurus that aren’t that good at day trading themselves.

Just think for a second; why would they sell you a course on day trading, when they could be making money day trading themselves?

Here are 3 great, completely free introductory courses you can watch on YouTube:

Free Day Trading Course by 1215 Day Trading

It offers 9 lessons with a total run time of over 2 hours, after which you’ll be equipped with a basic understanding of day trading.

If you’ve truthfully followed the previous step of learning the fundamentals, you’ll be surprised just how useful it was when watching these videos.

All the economic and financial lingo will make sense and you won’t have to stop the video every two seconds to google what something means.

Day Trading for Beginners: The Basics by Warrior Trading

Another great YouTube playlist for total beginners. Currently, it has over 30 videos with a total run time of several hours that will teach you everything you should know before starting to study from more advanced resources.

Intermediate Day Trader Playlist by The Moving Average

It includes over 65 videos on more complex concepts of day trading that you should study after building a solid foundation.

Each video covers a specific concept, strategy, or aspect of day trading, which makes it easy for you to consume.

Step 4. Start Reading Books

When you reach a beginner level, YouTube videos will stop bringing much value. To keep learning, you have to start reading books on day trading.

They are always more comprehensive than videos, and reading is the only way you can push your knowledge past the beginner’s level.

Here are 3 books that are some of the most recommended works on the advanced aspects of day trading:

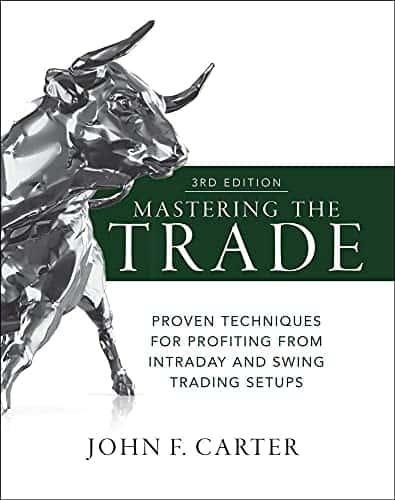

Mastering the Trade by John Carter

This 450-page behemoth is one of the best resources for improving the mental aspect of day trading.

Its author was raised by a stockbroker working at Morgan Stanley, which is one of the most reputable financial firms in the world, and that says enough for you to read this book.

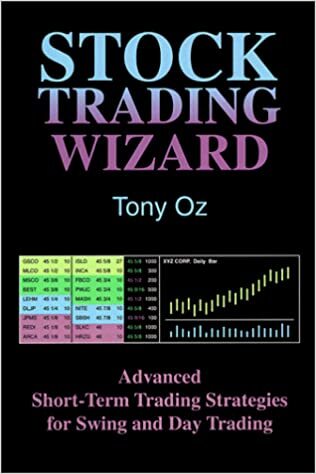

Stock Trading Wizard by Tony Oz

This book focuses on advanced strategies and presents formulas you can follow when day trading.

While blindly following a certain “recipe” is always discouraged, it can be a great resource for improving your knowledge.

Charting and Technical Analysis by Fred McAllen

This book delves deep into the technical aspect of price movements and chart analysis. It’s just 275-pages long but is one of the densest books on day trading that will make you truly understand day trading.

We recommend you read all of them, but don’t stop there. The internet is full of book recommendations and reviews that can help you pick out the best which are worth your time.

The key to becoming a day trader is to always keep learning.

Step 5. Day Trade

Finally, after you learned the basics and read dozens of books covering advanced aspects of day trading, you can actually start doing it yourself, but…

Before investing any of your money, you should practice on stock market simulators. It’s called “paper trading”.

Nearly every single trading platform offers “demo” accounts that are topped up with virtual money which you can use to trade stocks that change in price according to their real-life counterparts.

Look at your virtual money as if it was real. Promise yourself that you’re going to start day trading with your actual money after turning an $X profit during a Y-long period.

We can’t recommend exact values for X and Y, because it’s very personal and situation-specific.

However, we can recommend the X to be the amount you’d want to earn from real-world day trading in a Y-long period. The Y itself should at least be 3-months, but the longer, the better.

A period shorter than 3-months could be deceiving and make you jump into real trading too early.

-> Learn More about Self-Learning vs. Classroom Learning: Which Is Better?

Frequently Asked Questions

Q.1. How Much Can You Make From Day Trading?

A. It depends on your skill and budget. Best of the best day traders make millions, while the average day trader loses money. That’s right, an average day trader doesn’t turn a profit. In fact, just under 5% of all-day traders are successful.

Q.2. Is Day Trading Better Than Investing?

A. Day trading and investing are so different that it’s almost like comparing apples to oranges.

Long-term investing is a passive approach that will generate considerable profit just decades later.

Contrarily, day trading is an active approach that can show results the very same day you start, but it’s also much riskier and skill-demanding.

-> Learn more about the 7 best websites for self-learning

Final Thoughts

As you just saw, day trading is not for everyone. However, if you’re cut out for it, then you can become a day trader by yourself.

In fact, we advise against paying money for courses and coaching.

You can learn everything you need solely from free online resources and books.